net investment income tax 2021 trusts

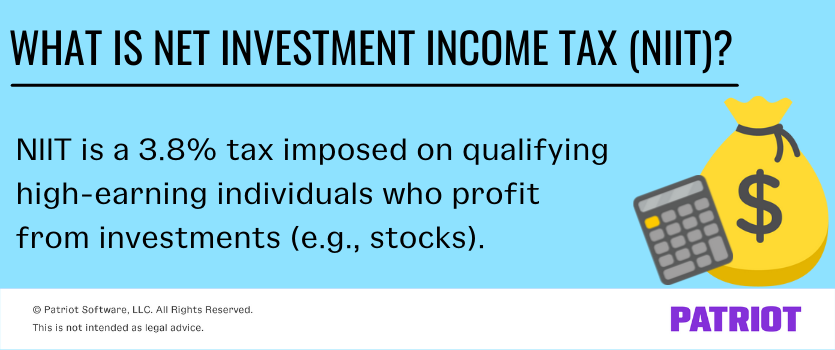

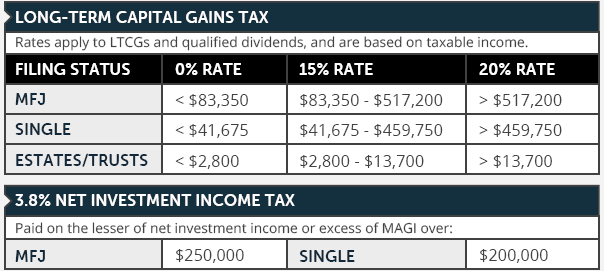

New Look At Your Financial Strategy. The net investment income tax NIIT is a 38 tax on investment income such as capital gains dividends and rental property income.

Aca Tax Law Changes For Higher Income Taxpayers Taxact

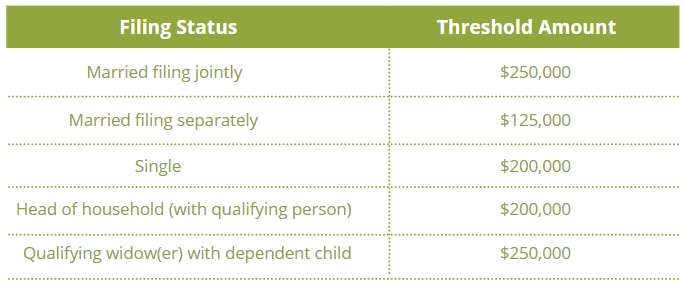

The Net Investment Income Tax does not apply to any amount of gain that is excluded from gross income for regular income tax purposes 250000 for single filers and.

. These tax levels also apply to all income generated by estates. The estates or trusts portion of net investment income tax is calculated on Form. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts.

1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted. The highest trust and estate tax. Subtract Part II Line 11 from Part I Line 8.

For 2021 a trust is subject to NIIT on the lesser of the undistributed net investment income or the excess of adjusted gross income over of 13050. The standard rules apply to these four tax brackets. Download our free guide to learn to get the most out of your retirement funds.

20 2019 the excise tax is 2 percent of net investment income but is reduced to 1 percent in certain. Effective January 1 2013 Code Sec. Trusts Estates and the Net Investment.

Visit The Official Edward Jones Site. 2022-08-08 Since January 1 2013 a 38 Medicare tax known formally as the Net Investment Income Tax NIIT aka Medicare surtax applies to certain investment income of. As a result any net investment income generated by the trust is included in the grantors net investment income potentially subject to the 38 tax at the individual level.

Part III helps determine total net investment income tax Line 12. Ad Download this must-read guide about retirement income from Fisher Investments. Generally net investment income includes gross income from interest dividends annuities and royalties.

From within your TaxAct return Online or Desktop click on the Federal tab. April 28 2021 The 38 Net Investment Income Tax. So for example if a trust earns 10000 in income during.

If this is not a positive number enter 0. Ad An Edward Jones Financial Advisor Can Partner Through Lifes Moments. Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income.

What Is Net Investment Income Tax Overview Of The 3 8 Tax

How To Calculate The Net Investment Income Properly

Income Tax Challenges And Smart Planning For Irrevocable Trusts 1

What Is The 3 8 Net Investment Income Tax Niit Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Net Investment Income Tax Niit Quick Guides Asena Advisors

Maximizing The Investment Interest Deduction

Build A Tax Efficient Taxable Account As A Physician Wealthkeel

How To Calculate The Net Investment Income Properly

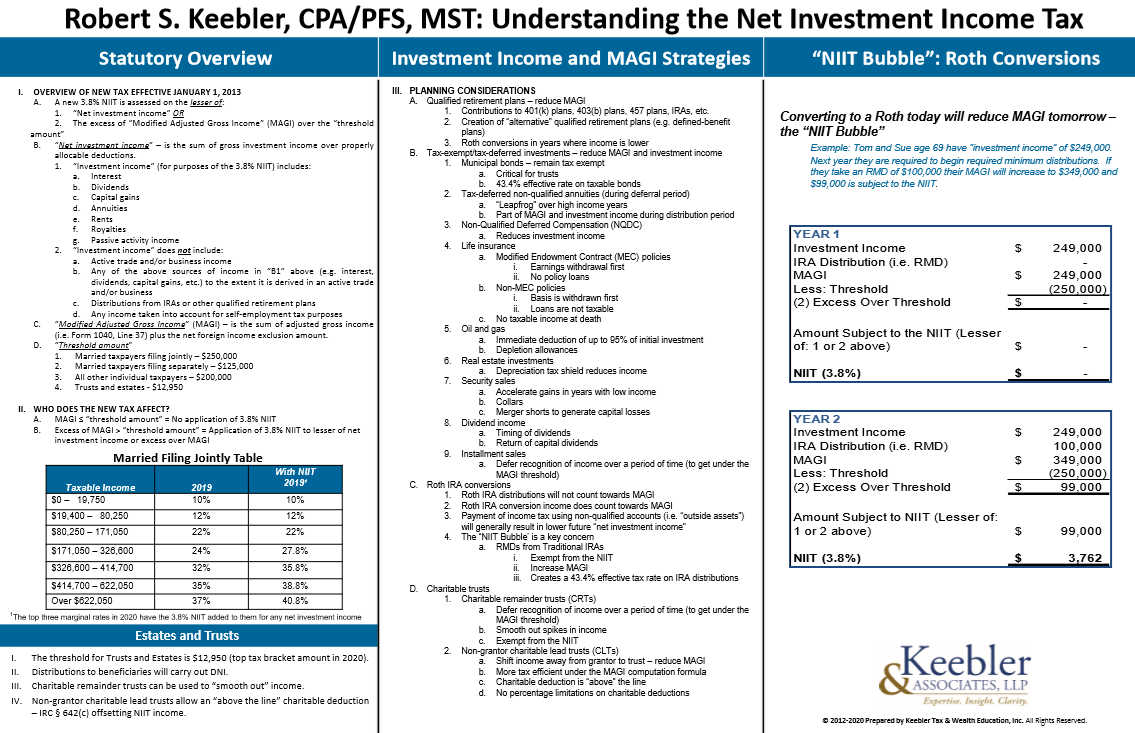

2022 Understanding The Net Investment Income Tax Chart Ultimate Estate Planner

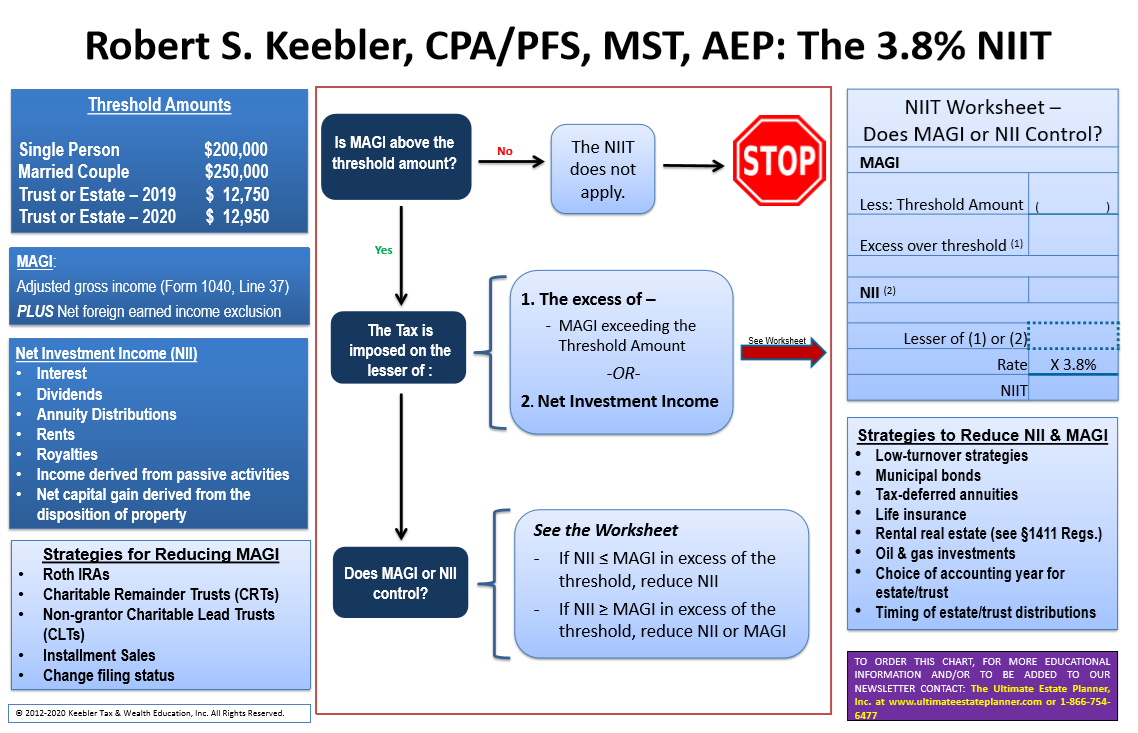

2022 Applying The 3 8 Net Investment Income Tax Chart Ultimate Estate Planner

Irs Form 8960 Fill Out Printable Pdf Forms Online

What Is The The Net Investment Income Tax Niit Forbes Advisor

Planning For A Liquidity Event It Is Life Changing Avier Wealth Advisors

What Is The 3 8 Medicare Tax Or Net Investment Income Tax Niit Legal 1031

2022 Understanding The Net Investment Income Tax Chart Ultimate Estate Planner

How To Calculate The Net Investment Income Properly

Net Investment Income Tax For 1040 Filers Perkins Co

8960 Net Investment Income Tax 8960 K1 Schedulec Schedulee Schedulef